Tesla is preparing to report what could be its largest quarterly revenue decline in more than ten years. The drop is fueled by slowing vehicle deliveries, growing EV competition, and a lack of new model launches that has dulled consumer interest.

Concerns Over Elon Musk’s Political Focus

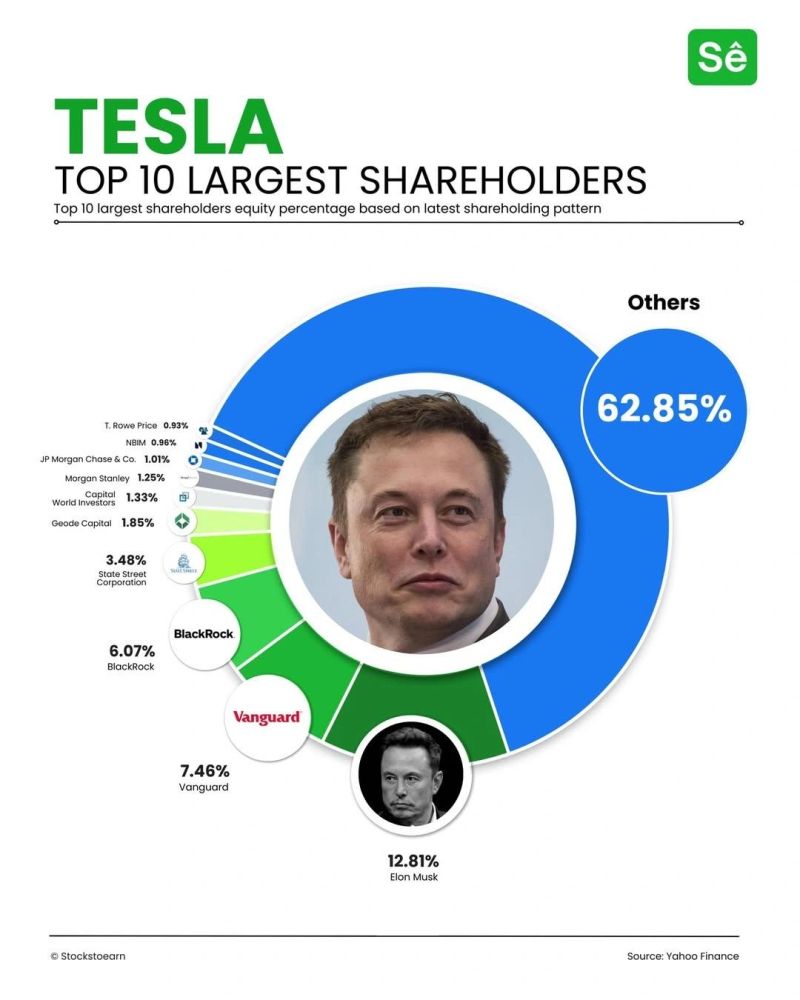

Investors are increasingly anxious about Elon Musk’s involvement in politics, particularly after his formation of the America Party and public clashes with Donald Trump. These distractions raise concerns about whether Musk is fully focused on resolving Tesla’s core business challenges.

Uncertainty Around Robotaxi Rollout

All eyes are on Tesla’s autonomous vehicle ambitions. A limited robotaxi trial with Model Y vehicles is underway in Austin, Texas, but expansion to other regions still awaits regulatory approval. Investors are demanding a clearer timeline and strategy for broader deployment.

Delayed Affordable Model Raises Doubts

Tesla’s long-promised entry-level electric vehicle has not met its production targets. While originally expected by mid-2025, the low-cost version of the Model Y has yet to be released. Analysts now predict reduced output, raising doubts about Tesla’s ability to compete in the mass-market EV segment.

Model Y Refresh Fails to Lift Sales

Despite updates to the Model Y, including design tweaks and new interior features, the vehicle saw a 13.5% year-over-year decline in deliveries for Q2. Production delays were cited, but analysts also criticized the refresh as being too minor to attract new buyers.

Declining Regulatory Credit Revenue Poses Risk

Tesla has relied heavily on selling emissions credits to maintain profitability, generating $2.8 billion in 2024. However, with global regulatory shifts, that revenue stream is expected to shrink, potentially impacting future financial performance.